(TheNewswire)

| |||||||||

|  |  | |||||||

Vancouver, British Columbia – TheNewswire - February 12, 2024 - Headwater Gold Inc. (CSE:HWG) (OTC:HWAUF) (the "Company" or "Headwater") is pleased to announce assay results from the maiden drill program at its Midas North project, Nevada. Drilling was fully funded by a subsidiary of Newmont Corporation (“Newmont”) (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM) pursuant to the option and earn-in agreement (the “Earn-In Agreement”) announced on August 16, 2022.

Highlights:

-

The Midas North project hosts a large, previously undrilled epithermal alteration cell in the northern Midas District, Nevada, located approximately 13 km north of Hecla Mining Company’s (“Hecla”, NYSE: HL) past-producing Midas Mine;

-

Nine widely spaced scout drill holes were completed by Headwater totaling 4,202 metres, designed to test six target areas. Epithermal veining and alteration were encountered in multiple target areas across the property;

-

Drill hole MN23-02 returned 47.0 g/t silver over 9.14 m below the Big Opal sinter and drill hole MN23-06, targeting the Jo Belle fault, intersected 0.51 g/t Au over 1.52 metres;

-

First-pass evaluation of initial target areas at Midas North was successful in identifying mineralized epithermal veining and favorable alteration at depth, providing critical vectors to guide future drilling on the property targeting high-grade gold in mineralized structures; and

-

The Company continues to review data in consultation with earn-in partner Newmont to prioritize potential follow-up work on the project.

Caleb Stroup, the President and CEO of the Company, states: “We are very encouraged by the results of our initial scout drill program at Midas North, which constituted the first known drilling on the property. This first-pass program has confirmed that alteration and epithermal veining persist at depth below surface alteration and has identified anomalous precious metals at depth in multiple areas. The Big Opal and Jo Belle fault corridors exhibit the most consistent and intense alteration with several intersections of anomalous precious metals, including 47.0 g/t silver over 9.1 m below the Big Opal sinter in drill hole MN23-02. Our geologists are also highly encouraged by the initial core intersection of the Big Opal fault target, where drill hole MN23-04 intercepted a fault-hosted epithermal quartz vein (Figure 2) with abundant quartz after bladed calcite textures and weak banding of chalcedonic quartz. These vein textures and associated alteration demonstrate the presence of a structurally hosted epithermal cell that experienced epithermal boiling conditions favourable for high-grade precious metal mineralization. Despite the low tenor of the gold values, the Company considers the presence of epithermal quartz veins highly significant. The wide-spaced pattern of holes (up to 1 km spacing) has significantly increased our understanding of the subsurface geology and provided clear vectors toward at least two priority areas to focus follow-up work and continue to explore for high-grade gold mineralization.”

Figure 1: Map of the Midas high-grade vein district in northern Nevada. Headwater Gold’s Midas North project adjoins Hecla Mining Company’s past-producing Midas Mine complex and encompasses another large epithermal alteration cell along trend and directly north of the Midas Mine.

2023 Drill Program:

The Company utilized a combination of diamond core and reverse circulation (“RC") drilling at Midas North to complete nine wide spaced drill holes totaling 4,202 metres. Drilling intersected epithermal veining and alteration in multiple target areas. This maiden drill program consisted of drill holes (Figure 3) designed to test the large epithermal alteration cell on the property and a variety of targets generated from initial geologic and geophysical work (see news release dated April 20, 2023).

Figure 2: Core photograph of fault-hosted epithermal quartz vein from drill hole MN23-04 exhibiting quartz-after-calcite lattice textures and weak banding of chalcedonic quartz indicative of epithermal boiling. Depth on run block shown in feet.

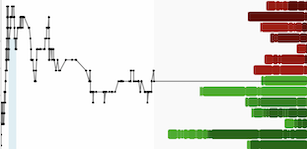

Figure 3: Geologic map showing the location of the scout drill holes at Midas North with target areas as interpreted from anomalous pathfinder element geochemistry in surface sampling and drill holes. Cross section A–A’ corresponds to Figure 4 below.

The primary objective of the program was to perform a first-pass evaluation of six discrete target areas at multiple elevations to assess the strength of epithermal alteration at depth and ultimately guide future drilling on the property toward the most favourable structures. Drilling confirmed the presence of widespread epithermal alteration and identified anomalous precious metals at depth in multiple areas. Geologic logging has resulted in a much-improved understanding of the subsurface stratigraphy and identified the presence of the Esmeralda, Elko Prince and June Belle formations at depth, which are favourable hosts of mineralization at the past-producing Midas Mine to the south. In addition, a number of prospective structures identified through geologic mapping and geophysical analysis (see news release dated April 21, 2022) were intercepted as predicted from geologic modeling.

Scout RC drill hole MN23-02 was drilled below an outcropping zone of opaline silica and sinter with fossilized geyser vents, within the Big Opal fault corridor (Figure 3). This drill hole intersected 47.0 g/t silver over 9.14 m from 371.86 m to 381.00 m in a structurally controlled high-resistivity feature underlying the silica sinter exposure. The mineralized interval consists of quartz-calcite-sulfide veining hosted in a gabbroic sill, which typically acts as a poor host for mineralization within the Midas district. This intercept represents the most significant precious metal anomaly identified on the property to date and highlights the potential for epithermal vein-style gold mineralization within more favourable host units laterally along strike or at depth.

Drill hole MN23-04, located approximately 1 kilometre south of hole MN23-02 along the Big Opal fault corridor (Figure 3) intersected a 3-metre-wide fault zone hosting a quartz vein with quartz-after-calcite lattice textures (Figure 2). Lattice-bladed and weakly banded quartz veining is consistent with epithermal boiling as the product of a high-energy geothermal system and implies potential for mineralized feeder structures deeper into the boiling zone at depth or laterally along strike. This vein returned highly anomalous pathfinder geochemistry with weakly anomalous gold and silver values. The significant strike length between low-grade mineralization encountered in hole MN23-02 to the northwest and epithermal veining in hole MN23-04 to the southeast indicate over a kilometre of prospective and untested strike extent along the Big Opal fault corridor, as corroborated by anomalous surface and drill hole pathfinder element geochemistry across the area (Figure 3).

The westernmost scout RC drill hole, MN23-06, targeted the district-scale Jo Belle fault and intersected 0.51 g/t Au over 1.52 metres from 225.55 m to 227.08 m within the fault zone (Figure 4). This low-grade precious metal intercept, along with highly anomalous mercury and arsenic values across a broad interval of MN23-06, suggests alteration is strongly fault-controlled. More drilling is required to adequately test this structurally controlled alteration along strike across the western portion of the property.

Figure 4: Interpretive cross section A–A’ showing correlation of elevated mercury and arsenic values with interpreted structures from CSAMT geophysics. The Jo Belle fault corridor hosts anomalous mercury (samples up to 75.37 ppm Hg) and arsenic values in an interpreted alteration halo surrounding the Jo Belle Fault, as well as the low-grade precious metal intercept encountered in MN23-06.

The 2023 drill program at Midas North also demonstrated the utility of controlled-source audio-frequency magnetotelluric (“CSAMT”) resistivity geophysical interpretation for target generation at the property. Geologic mapping and modeling efforts are limited by relatively poor preservation of outcrop exposures and a pervasive silica altered alteration cap. Interpretation of CSAMT has assisted with mapping of large-scale structures and prospective high-resistivity features at depth. Nearly all the 2023 drill holes which encountered fault zones and associated epithermal pathfinder element geochemistry were predicted by the geophysics, demonstrating the efficacy of this approach at the project. Stratigraphic and structural controls from the broadly spaced drill holes will provide significantly improved constraints for the Company’s evolving geologic model and will greatly aid future exploration. Headwater geologists believe the fault-hosted epithermal alteration and veining encountered in multiple drill holes suggest the potential for high-grade mineralization within the refined target areas remains.

About the Midas North Project:

Headwater’s 100% owned and royalty-free Midas North project adjoins Hecla Mining Company’s past producing Midas Mine complex to the north and covers a large hydrothermal alteration cell, extending at least 4 kilometres in strike and 1 kilometre in width. Geologic mapping, surface sampling and geophysics completed by the Company in the project area has highlighted several priority areas to explore for high-grade epithermal veins at depth. Extensive epithermal alteration exists on the project, including widespread zones of high-level chalcedonic to opaline silica flooding, clay alteration and local sinter formation with fossilized geyser vents. The project has seen very limited historic exploration with no documented exploration drilling. Midas North is subject to Newmont’s option to acquire up to a 75% interest in the Project following expenditures totaling US$30,000,000 and the completion of a Pre-Feasibility Study within a designated timeframe.

About Headwater Gold:

Headwater Gold Inc. (CSE: HWG, OTCQB: HWAUF) is a technically-driven mineral exploration company focused on the exploration and discovery of high-grade precious metal deposits in the Western USA. Headwater is aggressively exploring one of the most well-endowed and mining-friendly jurisdictions in the world with a goal of making world-class precious metal discoveries. Headwater has a large portfolio of epithermal vein exploration projects and a technical team comprised of experienced geologists with diverse capital markets, junior company and major mining company experience. The Company is systematically drill testing several projects in Nevada and Idaho and in August 2022 and May 2023 announced significant transactions with Newmont Corporation where Newmont acquired a 9.9% strategic equity interest in the Company and entered into several earn-in agreements on Headwater’s projects.

Headwater is part of the NewQuest Capital group which is a discovery-driven investment company that builds value through the incubation and financing of mineral projects and companies. Further information about NewQuest can be found on the company website at www.nqcapitalgroup.com.

For more information, please visit the Company's website at www.headwatergold.com.

On Behalf of the Board of Directors

Caleb Stroup

President and CEO

+1 (775) 409-3197

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

Qualified Person:

The technical information contained in this news release has been reviewed and approved by Scott Close, P.Geo (158157), a “Qualified Person” (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Sampling Quality Control:

Drill core was transported from the Project to the Company’s logging facility in Sparks, Nevada. Core was then logged in detail, split in half using an electric-powered core saw, sampled at specified intervals, bagged and delivered to Bureau Veritas (“BV”) facilities in Sparks, Nevada. RC samples were bagged at the rig and transported directly from the Project to BV. Samples were prepared by crushing and grinding via BV method PRP70-500 to obtain a 500g sub-sample. Geochemical analyses including fire assay were carried out at ISO 17025:2017 accredited Bureau Veritas laboratories in Vancouver, British Columbia. Pulps were assayed for 59 elements via method MA250 using a 25g sample after a four acid near total digest with an ICP-MS finish. Gold was assayed by fire assay using BV method FA330 with a 30g sample charge and ICP-ME finish. In addition to the laboratory's quality control program, a rigorous quality assurance and quality control program is implemented by the Company involving the insertion of blanks, standards and duplicates to ensure reliable assay results. Laboratory standards and QA-QC are monitored by the Company.

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, exploration activities and the specifications, targets, results, analyses, interpretations, benefits, costs and timing of them, Newmont’s anticipated funding of the earn-in projects and the timing thereof, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as “pro forma”, “plans”, “expects”, “may”, “should”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “potential” or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, risks related to the anticipated business plans and timing of future activities of the Company, including the Company’s exploration plans and the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, the risk that Newmont will not elect to obtain any additional interest in the earn-in projects in excess of the minimum commitment, the ability of the Company to obtain the required permits, changes in laws, regulations and policies affecting mining operations, the Company’s limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading “Risk Factors” in the Company’s prospectus dated May 26, 2021 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements, except as otherwise required by law.

Copyright (c) 2024 TheNewswire - All rights reserved.