Welchau-1 Intersects 115 Metres of Condensate-Rich Gas at Target Formation

VANCOUVER, BC, March 18, 2024 /CNW/ - MCF Energy Ltd. (TSXV: MCF) (FRA: DC6) (OTCQX: MCFNF) ("MCF", "MCF Energy" or the "Company") is pleased to announce a potentially significant gas and condensate discovery at the Welchau-1 well in Austria. The well encountered 115 metres of rich gas shows between 1,452 metres and 1,567 metres with strong evidence of natural fracturing, essential for gas production performance. A hydrocarbon seal was confirmed above the primary target, mitigating a major risk with the project. The Welchau prospect, over 100 square kilometres, is near pipelines and offers numerous potential drilling sites. Initiatives for testing, detailed analysis, and forward planning are currently underway.

The Welchau-1 well was drilled to a total depth of 1,733.1 metres using an 8 ½-inch bit. A suite of wireline logging tools, along with an MDT formation test tool, will be deployed for downhole pressure measurement, inflow testing, and formation fluid sampling in the targeted zones. Following the logging phase, a 7-inch production casing will be installed and cemented to secure the wellbore for subsequent testing, stimulation, and potential production activities.

Above the primary target, drilling encountered a 380-metre section of the Lunz Formation, which has effectively trapped gas and condensate. This formation served as an essential seal, with results from this well successfully mitigating initial concerns about its quality and thickness.

The well reached its main target, the Steinalm Formation, at a depth of 1,452 metres, aligning closely with the anticipated geological model. The Steinalm Formation is the same zone which flowed gas and condensate from the down dip Molln-1 well, drilled previously by OMV in 1989.

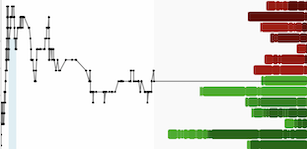

The Welchau-1 well encountered rich gas shows over a 115-metre interval from 1,452 to 1,567 metres. Fluorescence indicating the presence of liquid hydrocarbons was observed from 1,507 to 1,563 metres. The highest gas peaks were associated with fractures in the limestone, accompanied by a hydrocarbon odour in unwashed samples. The deepest gas shows were found at a depth of 1,645 metres. The compositional analysis of the gas shows at Welchau closely matches the condensate-rich gas previously tested in the Molln-1 well.

The Steinalm Formation is extensively fractured, exhibiting gas shows ranging from Methane (C1) to Iso Pentane (C5), indicative of mobile natural gas enriched with liquid condensates. A whole core was extracted from the formation between 1,511 and 1,519 metres to analyse rock characteristics such as lithology, mineralogy, stratigraphy, and petrophysical properties. This information aims to enhance gas production completion and performance. A continuous core of seven metres was recovered, sectioned into one-metre segments, and stabilised with foam for laboratory transport. Examination of the cut surfaces confirmed the existence of an extensive natural fracture system.

During the core recovery and preservation process, a strong gasoline odour was noted emanating from the core barrel. The visible ends of the cut core sections revealed a highly fractured carbonate structure. Image 1 displays a cut section of the recovered core.

The well achieved its Total Depth of 1,733.1 metres at 17:22 Central European Time on Sunday, March 17. It appears the wellbore penetrated beneath the main thrust fault responsible for the formation of the Welchau anticline structure and commenced drilling into what is believed to be the younger Reifling Formation located below the fault before reaching the Total Depth.

The drilling of the well was carried out both efficiently and safely, experiencing only minor losses of drilling mud fluid and no significant drilling issues. The rate of penetration surpassed expectations set in the original plan, thanks to new drilling technology. The project is advancing as anticipated, with plans to complete the well for testing and eventual production aligning with the success case scenario. The costs associated with this phase are consistent with initial projections.

ADX and MCF have complied with and aimed to surpass all environmental regulations throughout the drilling process. This commitment to environmental stewardship is expected to continue into the upcoming completion operations, with efforts to exceed standards wherever feasible.

MCF Energy will fund the Welchau-1 well costs up to 50% of the cap of EUR 5.1 million and 25% of any well costs exceeding the cap to earn a 25% economic interest in the Welchau Investment Area. The Welchau gas prospect has exceptional gas resource potential, located in the heart of Europe at a relatively shallow drill depth and proximal to gas pipelines.

James Hill, CEO and a Director of MCF Energy, stated "The results we have seen after entering the target zone are exactly what we had hoped for in a gas discovery well. The discovery of gas and hydrocarbons in the massive Welchau structure could be a game changer for Austria in the struggle for energy security and independence."

MCF Energy invites all stakeholders, including shareholders, employees, and the public, to stay updated on the Company's progress and its role in Europe's energy future, through its corporate website and social media.

MCF Energy was established in 2022 by leading energy executives to strengthen Europe's energy security through responsible exploration and development of natural gas resources within the region. The Company has secured interests in several significant natural gas exploration projects in Austria and Germany with additional concession applications pending. MCF Energy is also evaluating additional opportunities throughout Europe. The Company's leaders have extensive experience in the European energy sector and are working to develop a cleaner, cheaper, and more secure natural gas industry as a transition to renewable energy sources. MCF Energy is a publicly traded company (TSX.V: MCF; FRA: DC6; OTCQX: MCFNF) and headquartered in Vancouver, British Columbia. For further information, please visit: www.mcfenergy.com.

Additional information on the Company is available at www.sedarplus.ca under the Company's profile.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Forward-Looking Information

This press release contains forward-looking statements and forward-looking information (collectively "forward-looking information") within the meaning of applicable securities laws relating to the Company's plans and other aspects of our anticipated future operations, management focus, strategies, financial, operating and production results, industry conditions, commodity prices and business opportunities. In addition, and without limiting the generality of the foregoing, this press release contains forward-looking information regarding the anticipated timing of development plans and resource potential with respect to the Company's right to assets in Austria. Forward-looking information typically uses words such as "anticipate", "believe", "project", "expect", "goal", "plan", "intend" or similar words suggesting future outcomes, statements that actions, events or conditions "may", "would", "could" or "will" be taken or occur in the future.

The forward-looking information is based on certain key expectations and assumptions made by MCF Energy's management, including expectations and assumptions noted subsequently in this press release under oil and gas advisories, and in addition with respect to prevailing commodity prices which may differ materially from the price forecasts applicable at the time of the respective Resource Audits conducted by GCA, and differentials, exchange rates, interest rates, applicable royalty rates and tax laws; future production rates and estimates of operating costs; performance of future wells; resource volumes; anticipated timing and results of capital expenditures; the success obtained in drilling new wells; the sufficiency of budgeted capital expenditures in carrying out planned activities; the timing, location and extent of future drilling operations; the state of the economy and the exploration and production business; results of operations; performance; business prospects and opportunities; the availability and cost of financing, labour and services; the impact of increasing competition; the ability to efficiently integrate assets and employees acquired through acquisitions, the ability to market natural gas successfully and MCF's ability to access capital. Although the Company believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because MCF Energy can give no assurance that they will prove to be correct. Since forward-looking information addresses future events and conditions, by its very nature they involve inherent risks and uncertainties. MCF Energy's actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits that we will derive therefrom. Management has included the above summary of assumptions and risks related to forward-looking information provided in this press release in order to provide securityholders with a more complete perspective on future operations and such information may not be appropriate for other purposes.

Readers are cautioned that the foregoing lists of factors are not exhaustive. These forward-looking statements are made as of the date of this press release and we disclaim any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

Oil & Gas Advisories

Boe means a barrel of oil equivalent on the basis of 6 Mcf of natural gas to 1 barrel of oil equivalent. Mcfe means one thousand cubic feet of natural gas equivalent on the basis of 6 Mcfe: 1 barrel of oil. A boe conversion ratio of 6 Mcf: 1 Boe and 6 Mcfe: 1 bbl. are based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given the value ratio based on the price of crude compared to the price of natural gas at various times can be significantly different from the energy equivalence of 6 Mcf: 1 boe or 6 Mcfe: 1 bbl., using Boe's and Mcfe's may be misleading as an indication of value.

Prospective Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective resources have both an associated chance of discovery and a chance of development. Prospective Resources are further subdivided in accordance with the level of certainty associated with recoverable estimates assuming their discovery and development and may be sub classified based on project maturity.

Not all exploration projects will result in discoveries. The chance that an exploration project will result in the discovery of petroleum is referred to as the "chance of discovery." Thus, for an undiscovered accumulation, the chance of commerciality is the product of two risk components — the chance of discovery and the chance of development.

Estimates of resources always involve uncertainty, and the degree of uncertainty can vary widely between accumulations/projects and over the life of a project. Consequently, estimates of resources should generally be quoted as a range according to the level of confidence associated with the estimates. An understanding of statistical concepts and terminology is essential to understanding the confidence associated with resources definitions and categories. These concepts, which apply to all categories of resources, are outlined below. The range of uncertainty of estimated recoverable volumes may be represented by either deterministic scenarios or by a probability distribution. Resources should be provided as low, best, and high estimates as follows:

- Low Estimate and/or 1C in the case of Contingent Resources: This is considered to be a conservative estimate of the quantity that will actually be recovered. It is likely that the actual remaining quantities recovered will exceed the low estimate. If probabilistic methods are used, there should be at least a 90 percent probability (P90) that the quantities actually recovered will equal or exceed the low estimate.

- Best Estimate and/or 2C in the case of Contingent Resources: This is considered to be the best estimate of the quantity that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater or less than the best estimate. If probabilistic methods are used, there should be at least a 50 percent probability (P50) that the quantities actually recovered will equal or exceed the best estimate.

- High Estimate and/or 3C in the case of Contingent Resources: This is considered to be an optimistic estimate of the quantity that will actually be recovered. It is unlikely that the actual remaining quantities recovered will exceed the high estimate. If probabilistic methods are used, there should be at least a 10 percent probability (P10) that the quantities actually recovered will equal or exceed the high estimate.

This approach to describing uncertainty may be applied to reserves, contingent resources, and prospective resources. There may be significant risk that sub commercial and undiscovered accumulations will not achieve commercial production, however, it is useful to consider and identify the range of potentially recoverable quantities independently of such risk.

Bcf | billion cubic feet |

Bcfe | billion cubic feet of natural gas equivalent |

Bbl | barrels |

Boe | barrels of oil equivalent |

M | thousand |

MM | million |

MMbbls | million barrels of oil |

MMBOE | million barrels of oil equivalent |

MMBC | million barrels of condensate |

Mcfe | thousand cubic feet of natural gas equivalent |

MMcfe/d | million cubic feet equivalent per day |

Tcf | trillion cubic feet |

Km2 | square kilometers |

€ | Euros |

SOURCE MCF Energy Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/18/c2252.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/18/c2252.html