TORONTO, Aug. 27, 2020 /CNW/ - Horizons ETFs Management (Canada) Inc. ("Horizons ETFs" or the "Manager") is pleased to announce that it has completed proposed changes to the investment objectives of the BetaPro Natural Gas 2x Daily Bull ETF ("HNU") and the BetaPro Natural Gas -2x Daily Bear ETF ("HND" and together with HNU, the "ETFs").

At a special meeting of unitholders of HNU and HND (the "Meeting") held on August 20, 2020, unitholders approved all matters related to proposed changes to the investment objectives of the ETFs previously announced on July 3, 2020, and further described in an information circular that was made available to shareholders.

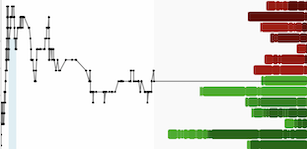

The new investment objectives change the underlying index used by the ETFs and allow adjustment of the leverage ratio employed by the ETFs to provide up to two-times positive (+200% for HNU) and up to two-times inverse (-200% for HND) the daily performance of the exposure to the Horizons Natural Gas Rolling Futures Index (the "New Natural Gas Index").

The New Natural Gas Index is a proprietary index owned and operated by Horizons ETFs, and calculated by an independent third party calculation agent, that will endeavour to provide exposure to as close to the front month natural gas futures contract as is deemed reasonable by the Manager, based on the current market conditions for natural gas futures contracts and subject to negotiations with the ETFs' counterparties.

The changes to the investment objectives took effect at the close of business on Thursday, August 27, 2020.

Additionally, Horizons ETFs is also changing the names of the ETFs. The name of HNU will be changed to the "BetaPro Natural Gas Leveraged Daily Bull ETF" and HND will be changed to the "BetaPro Natural Gas Inverse Leveraged Daily Bear ETF". The name changes will take place on or about Thursday, September 3, 2020, at close of business. The ticker symbols of the ETFs remain the same.

Leverage Ratio

Under the new investment objectives, the Manager anticipates, under normal market conditions, managing the leverage ratio to be as close to-two times (200%) as practicable for both HNU and HND. However, the Manager may, at its sole discretion, change the leverage ratio based on its assessment of the current market conditions for natural gas futures contracts and negotiations with the ETF's counterparties at that time.

The leverage ratio employed by the ETFs will be posted on the Manager's website at http://www.HorizonsETFs.com and any changes to the leverage ratio will be disclosed by way of public announcement.

With the implementation of the new investment objectives described above, the Manager has no expectation, at this time, of changing the leverage ratios that are currently being employed by the ETFs, nor does it anticipate any change to the natural gas front-month futures exposure or roll-methodology to which the ETFs are currently exposed.

About Horizons ETFs Management (Canada) Inc. (www.HorizonsETFs.com)

Horizons ETFs Management (Canada) Inc. is an innovative financial services company and offers one of the largest suites of exchange traded funds in Canada. The Horizons ETFs product family includes a broadly diversified range of solutions for investors of all experience levels to meet their investment objectives in a variety of market conditions. Horizons ETFs has over $14.6 billion of assets under management and 93 ETFs listed on major Canadian stock exchanges.

Commissions, management fees and expenses all may be associated with an investment in exchange traded products (the "Horizons Exchange Traded Products") managed by Horizons ETFs Management (Canada) Inc. The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Horizons Exchange Traded Products. Please read the relevant prospectus before investing.

The Horizons Exchange Traded Products include our BetaPro products (the "BetaPro Products"). The BetaPro Products are alternative mutual funds within the meaning of National Instrument 81-102 Investment Funds, and are permitted to use strategies generally prohibited by conventional mutual funds: the ability to invest more than 10% of their net asset value in securities of a single issuer, to employ leverage, and engage in short selling to a greater extent than is permitted in conventional mutual funds. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. The BetaPro Products include our Daily Bull and Daily Bear ETFs ("Leveraged and Inverse Leveraged ETFs"). Each Leveraged and Inverse Leveraged ETF seeks a return, before fees and expenses, that is either up to, or equal to, either 200% or –200% of the performance of a specified underlying index, commodity futures index or benchmark (the "Target") for a single day. The Leveraged and Inverse Leveraged ETFs use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Due to the compounding of daily returns a Leveraged and Inverse Leveraged ETF's returns over periods other than one day will likely differ in amount and possibly direction, from the performance of their respective Target(s) for the same period. The negative effect of compounding is more pronounced when combined with leverage and daily rebalancing in volatile markets. For Leveraged and Inverse Leveraged ETFs that seek up to 200% or up to or -200% leveraged exposure, the Manager anticipates, under normal market conditions, managing the leverage ratio as close to two times (200%) as practicable however, the Manager may, at its sole discretion, change the leverage ratio based on its assessment of the current market conditions and negotiations with the respective ETF's counterparties at that time. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment(s) remain consistent with their investment strategies.

Certain statements may constitute a forward-looking statement, including those identified by the expression "expect" and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author's current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

SOURCE Horizons ETFs Management (Canada) Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/August2020/27/c9176.html

View original content: http://www.newswire.ca/en/releases/archive/August2020/27/c9176.html