The investment principles of Jonathan Goodman and why Dundee Corp (TSX:DC-A), trading at a 64% discount to its portfolio value, may be a safer way to play junior mining.

At 15 years old, Jon Goodman bet the farm on a mining exploration stock.

He risked his entire $2000 net worth on Consolidated Morrison, tipped off by a broker during a summer job working at Merit Investment.

Over dinner at a Toronto steakhouse, Jon’s father Ned, an influential money manager, teased him about the bet. He said Morrison was a dog.

Breaking even, Jon cashed out the next day. Then Morrison tripled in a few weeks.

“You steered me the wrong way,” Jon complained to his father.

“I'm not at fault here,” Ned responded. “Had you done your own work, you wouldn’t have cared what I said.”

The lesson became a core principle of Jonathan Goodman.

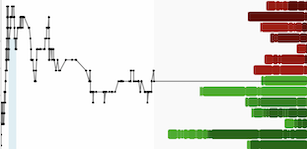

Today, Goodman leads mining-focused merchant bank Dundee Corporation (TSX:DC-A). In a series of interviews with TheBigScore, Goodman shared wisdom about his dual career in investment management and mining, and described how Dundee Corp is positioning itself for success.

Goodman’s insights on mining are some of the best I’ve heard. Read on to learn about them.

Keep reading (free) at TheBigScore https://www.thebigscore.com/p/jonathan-goodman-dundee-corp