Vancouver, British Columbia--(Newsfile Corp. - October 18, 2022) - Benchmark Metals Inc. (TSXV: BNCH) (OTCQX: BNCHF) (WKN: A2JM2X) (the "Company" or "Benchmark") - is pleased to report filing of its inaugural, baseline Preliminary Economic Assessment ("PEA") to SEDAR. The final NI 43-101 Technical Report has provided some enhanced metrics over the initial results published on August 16, 2022. The 100% owned Lawyers Gold-Silver Project (the "Project") is located within a road accessible region of the prolific Golden Horseshoe area of north-central British Columbia, Canada. The PEA presents a robust open pit mining operation with base case, attractive economics that has potential for additional gold-silver ounces and improved economics through facility design adjustments.

John Williamson, CEO, commented, "The Company is now exploring opportunities to enhance and improve the PEA. The PEA was based on open pitable resources only, we see opportunities to add higher-grade ounces below the pits through underground mining methods that could be accessed in parallel to surface mining operations. A significant number of underground ounces are clearly demonstrated by existing drill results defined to the Indicated and Inferred category. The Project has potential for more ounces and improved economics."

Robust Financial Metrics in a Tier 1 Jurisdiction

- Pre-tax NPV5% of C$939M, IRR 31.4%, and 2-year payback

- Pre-tax Net Operating Income of C$2,157M

- Base case metal price parameters of US$1,735 per ounce

- of gold and US$21.75 per ounce of silver

- After-tax NPV5% of C$589M, IRR 24.1%, and 2.8-year payback

Capital light development

- Initial capital of C$484M (including C$72.8M in contingency)

- Life of Mine capital of C$632M

- Strong 1.9:1 Pre-tax NPV5% to Initial Capex ratio

- Minimal pre-strip limited to TSF starter dam construction

Low All-In Sustaining Costs (AISC)

- US$ 786/Au oz (net of by-products)*

Long Mine Life with Expansion Opportunity

- Total resource production of 46.7 M tonnes over 12-year mine life

- Average annual production of 163k AuEq ounces

- LOM production 1.95M payable AuEq ounces

- Average AuEq Head Grade of 1.41 g/t

- Average gold recovery of 92.4%

*All-In Sustaining Costs (Net of By-Products) are calculated for the purpose of the Study as the sum of all operating costs (mining, processing, site administration and refining), reclamation and sustaining capital, minus the revenue from Ag, all divided by the gold ounces sold to arrive at the per ounce Au figure.

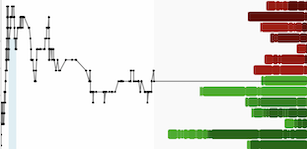

Graphic #1: 2022 Mineral Resource Estimate displaying Pit Locations and Opportunities for Additional Gold-Silver Ounces

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6169/141002_b8b42354e46b6a92_001full.jpg

Quality Assurance and Control

Results from samples were analyzed at ALS Global Laboratories (Geochemistry Division) in Vancouver, Canada (an ISO/IEC 17025:2017 accredited facility). The sampling program was undertaken by Company personnel under the direction of Rob L'Heureux, P.Geol. A secure chain of custody is maintained in transporting and storing of all samples. Gold was assayed using a fire assay with atomic emission spectrometry and gravimetric finish when required (+10 g/t Au). Analysis by four acid digestion with 48 element ICP-MS analysis was conducted on all samples with silver and base metal over-limits being re-analyzed by atomic absorption or emission spectrometry. Rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc, P. Geol., P.Geo., and Carly Church, P.Eng., PMP, qualified persons as defined by National Instrument 43-101.

Stock Options

The Company has granted incentive stock options to new directors to purchase up to 1 million common shares exercisable over a five year period at a price of $0.42 per share.

About Benchmark Metals

Benchmark Metals Inc. is a Canadian based gold and silver company advancing its 100% owned Lawyer's Gold-Silver Project located in the prolific Golden Horseshoe of northern British Columbia, Canada. The Project consists of three mineralized deposits that remain open for expansion, in addition to +20 new target areas along the 20-kilometre trend. The Company trades on the TSX Venture Exchange in Canada, the OTCQX Best Market in the United States, and the Tradegate Exchange in Europe. Benchmark is managed by proven resource sector professionals, who have a track record of advancing exploration projects from grassroots scenarios through to production.

ON BEHALF OF THE BOARD OF DIRECTORS

s/ "John Williamson"

John Williamson, Chief Executive Officer

For further information, please contact:

Jim Greig

Email: jimg@BNCHmetals.com

Telephone: +1 780 437 6624

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This news release may contain certain "forward-looking statements". Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/141002