Microsoft and Google's parent company Alphabet both outperformed expectations in terms of earnings and revenue, but the overall stock market took a hit due to slowing growth.

Following Microsoft's fiscal third-quarter earnings report, their shares got a boost in after-hours trading on Thursday. Microsoft reported revenue of $61.9 billion, just shy of its previous record, and earnings of $2.94 per share, surpassing the expected $2.82 per share. MSFT stock saw an increase of about 5% following the report.

In their fiscal third quarter, Microsoft noted that demand for AI exceeded available capacity. The company has heavily invested in Nvidia's AI-enabled servers to expand its artificial intelligence infrastructure and integrate AI models across its products.

Alphabet also reported impressive earnings, announcing its first-ever quarterly dividend of 20 cents per share. The company generated $80.5 billion in revenue and earned $1.89 per share, surpassing analysts' estimates and showing growth of 15% and 57%, respectively, compared to the same quarter last year. This news caused shares to soar by 11%, pushing Alphabet's stock to a new record high, surpassing the $2 trillion mark.

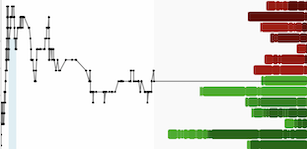

Despite these positive developments, the S&P 500 index dipped on Thursday due to reports of slowing growth in the US, dampening investor confidence. The first-quarter gross domestic product (GDP) expanded at a rate of 1.6% annually, falling short of analysts' projected 2.4% growth.

Additionally, there are indications that inflation may be resurging after a period of moderation, further tempering expectations for interest rate cuts this year. While slowing growth suggests an economic slowdown, the presence of inflationary pressures reduces the likelihood of rate cuts.