VANCOUVER, British Columbia, Oct. 14, 2022 (GLOBE NEWSWIRE) -- Regulus Resources Inc. ("Regulus" or the "Company", TSX-V: REG, OTCQX: RGLSF) is pleased to announce the completion of a US$5 million investment (the “Investment”) from Osisko Gold Royalties (“Osisko”) in exchange for a net smelter return (“NSR”) ranging from 0.125% to 1.5% on certain claims of the Company’s AntaKori project (“AntaKori”), as well as a right (currently held by Regulus) to buy-back a 1% NSR from a third party on certain claims of AntaKori. Proceeds from the Investment will be used for exploration activities at AntaKori and for general corporate purposes. This Investment is the second completed by Osisko on the AntaKori project. The first was the strategic partnership between Regulus and Osisko announced on October 1, 2020 (the “Strategic Partnership”).

Highlights

- The Investment represents a significant financing in challenging capital markets.

- No incremental royalties on the claims where Osisko acquired a 0.75-1.5% NSR through the Strategic Partnership in 2020, where the majority of current NI 43-101 resources lie.

- Deal structured such that the NSR’s issued in relation to the Investment together with existing outstanding royalties will not exceed 1.5%.

- Brings cash into the treasury with no dilution to shareholders.

- The Investment allows Regulus to continue to advance exploration activities on the AntaKori project and maintain its social commitments.

- Represents a strong technical endorsement for the AntaKori project.

John Black, Chief Executive Officer of Regulus, commented as follows:

“The continued support of Osisko is a strong endorsement of the AntaKori project. Given that equity markets are currently very challenging, we believe this transaction adds value to shareholders by avoiding equity dilution while providing Regulus with cash to continue to advance work programs at AntaKori.”

“The next major milestone for the project will be a decision on the Colquirrumi earn-in claims whereby Regulus can earn up a to 70% interest from Buenaventura by completing 7,500 m of drilling. Upon completing the 7,500 m, Buenaventura can elect to either give Regulus a 70% interest in the claims or pay Regulus US$9 million and give Regulus a 30% interest in the claims, with Buenaventura retaining a 70% interest. We plan to complete the 7,500 m of drilling in October and expect a decision from Buenaventura in Q1 2023. With either a 70% or 30% interest, we retain the ability to layback onto these claims which will enable us to increase the size of the pit and thereby increase our resource base at AntaKori. With two drill rigs active on the project, we will continue drilling to expand the mineralized footprint of the project, with the target of completing a resource update around mid-2023.”

Details of the Transaction

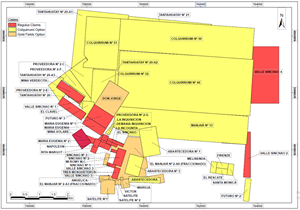

Regulus, through its wholly owned Peruvian subsidiary, will grant to Osisko an NSR on certain claims of AntaKori ranging from 0.125% to 1.5%. As well, Regulus will transfer a right to buyback a 1% NSR for US$4.5 M on the Maria Eugenia, Maria Eugenia No1 and Rita Margot claims. As per the Strategic Partnership, Osisko previously held the right to acquire 50% of the 1% NSR on Maria Eugenia, Maria Eugenia No2 and Rita Margot if Regulus had exercised its buy-back right. In accordance with the Investment Agreement entered into by Osisko and Regulus, consideration of US$5 million was paid to Regulus on closing. See Table 1 and Figure 1 for details of where the new royalties will be applicable and the overall royalty profile of the project.

Corporate Update

The Company has entered into short-term loan agreements with certain directors and officers for approximately US$500,000. The loans are unsecured, bear interest at the rate of 10% per annum and are repayable by December 31, 2022, unless otherwise agreed to by the parties.

As a result of the insider participation in the short-term loans to the Company, these loan transactions are considered to be related party transactions subject to TSX Venture Exchange rules and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is relying on exemptions from the formal valuation and minority shareholder approval requirements provided under sections 5.5(a) and 5.7(a) of MI 61-101 on the basis that the loans did not exceed 25% of the fair market value of the Company's market capitalization.

Qualified Person

The scientific and technical data contained in this news release pertaining to the AntaKori project has been reviewed and approved by Dr. Kevin B. Heather, Chief Geological Officer, FAusIMM, who serves as the qualified person (QP) under the definition of National Instrument 43-101.

ON BEHALF OF REGULUS RESOURCES INC.

(signed) “John Black”

John Black

CEO and Director

Phone: +1 720-514-9036

Email: john.black@regulusresources.com

For further information, please contact:

Ben Cherrington

Phone: +1 1 347 394 2728

Email: ben.cherrington@regulusresources.com

About Regulus Resources Inc. and the AntaKori Project

Regulus is an international mineral exploration company run by an experienced technical and management team. The principal project held by Regulus is the AntaKori copper-gold-silver project in northern Peru. The AntaKori project currently hosts a resource with indicated mineral resources of 250 million tonnes with a grade of 0.48 % Cu, 0.29 g/t Au and 7.5 g/t Ag and inferred mineral resources of 267 million tonnes with a grade of 0.41 % Cu, 0.26 g/t Au, and 7.8 g/t Ag (independent technical report prepared by AMEC Foster Wheeler (Peru) S.A., a Wood company, titled AntaKori Project, Cajamarca Province, Peru, NI 43-101 Technical Report, dated February 22, 2019 - see news release dated March 1, 2019). Mineralization remains open in most directions.

For further information on Regulus Resources Inc., please consult our website at www.regulusresources.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

Certain statements regarding Regulus, including management's assessment of future plans and operations, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Regulus' control. Often, but not always, forward-looking statements or information can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

Specifically, and without limitation, all statements included in this press release that address activities, events or developments that Regulus expects or anticipates will or may occur in the future, including the proposed exploration and development of the AntaKori project described herein, the completion of the anticipated drilling program, the completion of an updated NI 43-101 resource estimate and management's assessment of future plans and operations and statements with respect to the completion of the anticipated exploration and development programs, may constitute forward-looking statements under applicable securities laws and necessarily involve known and unknown risks and uncertainties, most of which are beyond Regulus' control. These risks may cause actual financial and operating results, performance, levels of activity and achievements to differ materially from those expressed in, or implied by, such forward-looking statements. Although Regulus believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The forward-looking statements contained in this press release are made as of the date hereof and Regulus does not undertake any obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities law.

Figure 1 – AntaKori Project Claims Map

| Table 1 - Royalties Outstanding on AntaKori Property Following the Investment | ||||

| Claim Name | Third Party NSR | Current Osisko Royalty | New Osisko Royalty | Total Royalty Outstanding |

| El Clavel | 1.50% | 1.50% | ||

| Mina Verdecita | 1.50% | 1.50% | ||

| Maria Eugenia No 1* | 1.375% | 0.125% | 1.50% | |

| Maria Eugenia* | 1.375% | 0.125% | 1.50% | |

| Maria Eugenia No 2 | 1.50% | 1.50% | ||

| Napoleon | 1.50% | 1.50% | ||

| Rita Margot* | 1.375% | 0.125% | 1.50% | |

| Demasia Inquisicion | 1.50% | 1.50% | ||

| La Inquisicion | 1.50% | 1.50% | ||

| La Incognita | 1.50% | 1.50% | ||

| El Sinchao | 1.50% | 1.50% | ||

| Sinchao No 1 | 2.0% | 2.00% | ||

| Sinchao No 2 | 2.0% | 2.00% | ||

| Sinchao No 3 | 2.0% | 2.00% | ||

| Tres Mosqueteros | 0.00% | |||

| Valle Sincaho 2 | 1.50% | 1.50% | ||

| Valle Sincaho 3 | 1.50% | 1.50% | ||

| Valle Sinchao 4 | 1.50% | 1.50% | ||

| Mina Volare | 0.750 - 1.50% | 0.750 - 1.50% | ||

| * A buyback right exists to purchase 1% of the Third Party NSR in exchange for US$4.5 M. This will be transferred to Osisko. | ||||

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3c59af14-5833-49b3-9797-91001d2d99f2