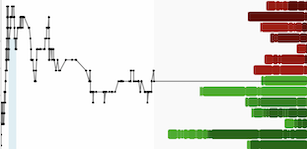

Over the past several years most commodities experienced substantial increases due to inflationary pressures & supply-side bottlenecks, but prices have recently retreated. Only lithium (“Li”) & thermal coal remain near all-time highs.

The battery-quality Li carbonate spot price in China is nearly triple the twin peaks of 1q 2016 & 4q 2017 (see chart below). Today’s price of 492,500 yuan/tonne is ~US$71,500/t. To be clear, the price in China is not the same as longer-term contract prices outside of China. Still, even contract levels are now approaching US$50,000/t.

Grades at hard rock projects range from under 1.0% to ~2.5% Lithium Oxide (LiO2). At US$50,000/t, 1.0% LiO2 has an in-situ value of US$1,235/t, (2.47 kg of Li carbonate/tonne) which equates to a gold deposit grading 22.3 g/t gold. This is why investors are so excited about hard rock Li projects.

Lithium mostly comes from hard rock mining in Australia, brines in Chile & Argentina, or brines & hard rock in China. Two countries that are expected to move up the rankings are the U.S. & Canada. There are several reasons for this.

First, the U.S. is a major electric vehicle market and regional sourcing of battery materials (Li, graphite, cobalt, nickel, manganese) has become incredibly important. OEMs & Li-ion battery makers are flocking to N. America to compete in the U.S.

Second, N. America has much lower electricity & natural gas costs than Europe, and much of Canada’s electrical grid is green.

Third, the world is clearly moving towards a China vs. the West paradigm. Countries aligning with China and/or Russia (and other despotic countries) in global trade & geopolitical realms will be less trusted by the West to reliably supply critically important battery materials.

Is Canada the best of all possible worlds?

When it comes to battery materials, Canada might be the best of all possible worlds — it has a green-energy footprint, AND its Li deposits are found in conventional, well-understood (hard rock) settings. No new technologies need to be commercialized to make Canada a Li powerhouse.

Moreover, the provinces of Quebec & Ontario are rapidly rising in electric vehicle & battery circles. Not just in N. America but on a global scale. OEMs incl. Volkswagen, GM, Stellantis, Honda & Mercedes-Benz have committed to operating in Ontario and/or Quebec, as well as battery makers Umicore, LG Energy Solution & BASF. Tesla is strongly rumored to be close to announcing a gigafactory in Quebec.

Both provinces have world-class consulting groups, investment funds & research universities to draw upon. Both offer financial assistance programs (tax breaks, partial cap-ex refunds, low-cost loans, grants, etc.).

Companies that have battery materials assets in Quebec & Ontario are well placed to attract investment. Many early-stage companies will do extremely well in this nascent bull market for battery materials. One name that looks especially attractive is Infinity Stone Ventures [GEMS] (CSE: GEMS) / (OTCQB: TLOOF).

On Aug. 31st, Patriot Battery Metals [PMET] announced its best Li drill results ever. This is a Quebec-based company — now valued at ~C$635M — that has yet to deliver a maiden resource.

GEMS has a growing land package adjacent to PMET’s 21,300-hectare Corvette project. GEMS’ 1,282-hectare (pro-forma for an option agreement on 100% of the Taiga Lithium Project) footprint is a “closeology” play. Make no mistake, there’s a wide range of closeology plays in the metals & mining world. Closeology never offers a guarantee of success.

There will be several major battery material mining hubs in Ontario & Quebec

Camaro & Taiga are within 1,500 meters of some of PMET’s highest-grade zones. Instead of being close to a mediocre-to-good mine, Camaro & Taiga border one of the most exciting Li stories in the world. So, how strong were PMET’s drill results?

Any Li2O grade of 1.0%+ is attractive, but only in conjunction with mineralized widths of 20+ meters does it stand out. In reviewing peer Canadian intervals, excellent grades of 1.5%+ pop up, but rarely combined with widths of > 20 meters. PMET just announced 1.65% LiO2 over a whopping 160 meters.

Am I suggesting that GEMS will be the next PMET because its 1,282 ha footprint is so close? No, but if Camaro & Traiga (plus further expansion around Corvette) could grow to 1/10 of what PMET seems destined to become, it would be a huge win.

An investment in PMET is up +3,618% from its 52-week low. Yesterday GEMS had a great showing, +20%, but its journey has only just begun. Importantly, Camaro & Taiga need not be the next Corvette for GEMS’ stock to take off.

PMET’s progress de-risks the GEMS story in meaningful ways. How? Even if Camaro & Taiga are not large enough or high enough grade to be a standalone mine, the properties could still become quite valuable as satellite deposits.

Serious investment capital to move more aggressively is coming into PMET’s coffers on the heels of yesterday’s drill results. Extensive drilling within several km of GEMS’ 1,282 ha prospects will provide very valuable data to inform GEMS’ drill targets.

All eyes on hard rock Li projects in Ontario & Quebec, is graphite soon to follow?

PMET is attracting a tonne of eyeballs to the James Bay region of Quebec; sell-side analysts, strategic partners, and coveted institutional investors.

In addition, northwest Ontario is going to be a globally-significant Li hub with multiple mines & production facilities. Rock Tech & Frontier Lithium could build mining complexes or be acquired by companies like Ganfeng, Livent, Allkem, Piedmont Lithium, Lithium Americas & Australian-listed Sayona Mining, all of whom already have toehold investments in Canada.

I would not be surprised to see Brazilian hard rock star Sigma Lithium or Lithium Triangle giants Albemarle & SQM kick the tires of select Canadian juniors. Or, if there’s an Australian invasion, Mineral Resources, Pilbara Minerals, IGO Ltd., Liontown Resources & Core Lithium could join the hunt. Importantly, Pilbara’s CEO [C$9.5B valuation] recently joined the board of PMET.

In many cases, Australian-listed Li companies enjoy premium valuations compared to Canadian-listed peers. An NYSE or full NASDAQ listing in the U.S. goes a long way as well. GEMS is in the process of becoming dual-listed in Australia & Canada.

As exciting as Camaro & Taiga are, they're just two of eight assets that GEMS owns or controls. Another is the combined 1,407-hectare PAK/PAK Southeast Li properties (covering several pegmatite units) directly adjacent to Frontier’s PAK project (same name). They share a 14-km boundary. In N. America only Frontier boasts intervals as strong as PMET’s.

GEMS is one of under five companies that has promising early-stage prospects in both Quebec & northwestern Ontario.

Galaxy is another Quebec Li property. It’s underlain by at least 30 pegmatite exposures representing 30 pegmatite dikes. Blasting & pitting has shown these pegmatites to have widths of 15 to 18 meters in outcrop. Analysis of the pegmatites shows anomalous quantities of lithium, tantalum, molybdenum, uranium & thorium.

High-grade natural graphite is as important as Li in batteries…

Infinity Stone Ventures is more than a Li company, it also has a promising graphite project 50 km west of Thunder Bay Ontario that boasts a discovery hole grading 25% graphite, a top-quartile industry grade. Drilling later this year at the Rockstone project could provide high-impact results.

Graphite, either natural or synthetic, is as important as lithium in today’s batteries. By volume, graphite is one of the most important elements in any EV battery chemistry, each containing 50 – 100 kg. Virtually all natural graphite comes from China, Brazil & Mozambique -- what could possibly go wrong?

Clearly, another Canadian supplier of high-grade natural graphite would be well received. Nouveau Monde (BFS-stage) is an example of a Quebec-based company that has done a great job. Its valuation is ~C$400M.

I will have a lot more to say about Infinity Stone Ventures (CSE: GEMS) / (OTCQB: TLOOF) in the coming months. I wanted to get an article out given how strong battery material fundamentals are.

As mentioned, there are eight properties/projects, all in Ontario or Quebec, spanning (at least) Li, graphite, nickel, cobalt, copper & manganese. No duds, all potential winners.

The top-10 performing Li companies (off of 52-week lows) are up an average of +1,004%! and have an avg. market cap of C$266M. GEMS has room to run. With 69M shares outstanding, it’s valued at C$24M.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Infinity Stone Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Infinity Stone Ventures are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Infinity Stone Ventures is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.