According to a new report by The Insight Partners, the solar market was valued at $207 billion last year and is projected to reach $552 billion in 2030. That would be a compounded annual growth rate (CAGR) of 13%. Silver is a critically important component in solar (photovoltaic) cells.

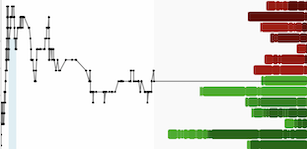

Solar power accounts for ~14% of global silver (“Ag“) demand vs. ~5% a decade ago. Although Ag in solar cells has been in decline for years, two new technologies are poised to increase content by 30%-120%, {see chart above}.

Even in these new cells the cost of the Ag will remain relatively low. Demand for Ag in solar power should grow 20%-30%/yr., meaning 10s of millions of additional ounces/yr. will be needed, and 100s of millions/yr. in the 2030s. This isn’t some pie-in-the-sky, long-term projection — it’s happening right now. Companies in production today are ideally positioned to benefit.

The Silver:Gold ratio is ~85:1 vs. a long-term average of 55-60:1. Strong demand for industrial uses like solar could shift this ratio. All else equal, a move to 70:1 would result in an Ag price of $27.6/oz. vs. ~$22.7/oz. (Oct. 13th).

Guanajuato Silver (TSX-v: GSVR) / (OTCQX: GSVRF) is a rapidly-growing Mexican Ag/Au producer, but it’s not immune to sector & country headwinds. The Company’s market cap is C$105M.

Most notably, the Mexican peso had been inexplicably strong vs. the USD, (until recently). The unprecedented peso strength could be behind us as it has weakened ~7.6% from the recent high. Industry-wide mining cost inflation isn’t helping either.

Last week Chairman & CEO James Anderson delivered an operational update for the Company’s four wholly-owned producing Ag mines; the El Cubo Mines Complex, Valenciana Mines Complex (“VMC“), San Ignacio in Guanajuato and Topia in Durango. New production guidance this year is 3.4 – 3.6M Ag Equiv. ounces.

Management continues to implement operational changes to enhance profitability as each mine continues to ramp up. However, as Mr. Anderson likes to say, Guanajuato buys “fixer-uppers,” assets that need work to optimize, integrate & expand.

The team has been buying mines + mills + Ag/Au resources at steep discounts, but fixer-uppers require cap-ex.

Unlike many small cap producers, Guanajuato is plowing ahead rather than sitting back and waiting for a better market. When silver prices rise, this company will fully benefit.

It’s a huge buyer’s market for Mexican mining assets. Anderson and team are looking for acquisitions of meaningfully undervalued mines / mills/ resources that can be optimized & expanded. Enhanced operational flexibility from multiple mines & mills continues to de-risk the story.

Guanajuato Silver’s valuation reflects the headwinds the Company and the sector are facing. As it emerges with streamlined & expanded operations, cap-ex will fall and all-in sustainable costs could decline to ~US$19/Ag Eq. oz. from ~$22.5/oz. on ~5M Ag Eq. ounces in 2025.

If one believes that Ag & Au prices are headed higher, and world events seem to support that thesis — then one wants to own a beaten down producer like Guanajuato Silver. Below $23-$24/oz., the long-term outlook is not that exciting, but each dollar above that makes a big difference.

In articles I wrote a year or two ago, I said the sweet spot was > $21-$22/oz. What’s changed? INFLATION. Yet, inflation is a two-way street. So far it has only increased production costs. Before long, the price of Ag & Au will adjust to reflect future (and capture past) cost pressures.

Consider that adjusted for inflation, silver’s all-time high from 1Q 1980 is $195/oz., it averaged $83/oz. for all of 1980. Why do I always mention the inflation-adj. price? Because the world has been experiencing high inflation!

This doesn’t mean Ag is headed above $100/oz. anytime soon, but there seems to be little stopping it from doubling or tripling. A triple would still be less than 40% of the all-time inflation-adj. high. Importantly, readers are reminded that ~70% of mined Ag is a by-product of other metals.

If the Ag price spikes, but 80%-90% of a mine’s economics come from other metals, an increase in production would not necessarily follow. Silver supply is highly inelastic, which is great news for primary Ag miners that can rapidly increase production.

Operational updates

The VMC restarted in January, 2023. Production has ramped up nicely to 20,000 tonnes/month with the help of the refurbished Cata shaft and a new underground locomotive system. The team is working on accessing higher grade areas in the northern part of the mine.

Also, the recovery of high-grade material from old pillars continues to support increased throughput.

The El Cubo Mines Complex is milling at ~22,000 tonnes/month, roughly half its total capacity. Operational upgrades designed to minimize dilution and maximize higher-grade vein material are being implemented.

For instance, more targeted mining practices and efforts to reduce the processing of mineralized backfill are being pursued. Development work is underway at El Cubo to increase production stopes from 12 to 20. By yearend, dewatering will allow access to deeper higher grade areas of the Villalpando mine.

Management has been improving safety & security conditions. After slowing activities for two weeks due to an accident, the mine is back to normal. Improvements to the ventilation system have been made, allowing for development & exploitation of the Melladito vein and associated veinlets. A drill hole there returned nearly five meters at > 1,200 g/t Ag Eq.

At Topia, very high-grade ore is being mined, but with high extraction costs due to narrow vein widths. To drive profitability, management is dramatically transforming operations through the exclusive use of local mine contractors.

Mining activities at Topia will be curtailed to focus on acquiring & processing mineralized material from the contractors. Additional cost-saving measures are being implemented, including staff reductions.

CEO Anderson commented,

“At Topia we have significantly grown the business of acquiring high-grade mineralized material from local miners. We have determined that this business model generates stronger margins than having our own mining crews. This is particularly true when working with Topia’s high-grade, but very narrow vein structures.”

For readers who believe that silver will remain around $23/oz., Guanajuato Silver (TSX-v: GSVR) / (OTCQX: GSVRF) is not for you. However, in a bull market where one cannot rule out sliver above $40-$50/oz. (even if for brief periods) — vs. the inflation-adj. high of $195/oz. — one wants to own producers in known jurisdictions with strong growth profiles.

Anderson and team have demonstrated they can grow, enhance & integrate operations. They’re hard at work trying to bring op-ex down and build a decades-long future in one of the world’s most famous & prolific silver districts. In today’s buyer’s market, growth to well beyond 5M ounces/yr. is quite possible (if not likely) by 2026-27.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.