Summary

- NexTech currently commands a unique position in an industry with the potential to treble in under a decade.

- The company has an adequate and well-rounded management team coming from a variety of backgrounds.

- NexTech has exhibited impeccable top-line growth alongside a solid liquidity position.

- The company is overpriced based on comparable analysis, however, investors that believe in the company's offerings may choose to overlook that.

- The company's business risk of never turning a profit, combined with the stock price volatility indicates that this is a high-risk, high-reward technology play.

Introduction

In the years since Google Glass was first unveiled and Pokémon Go became a worldwide hit on mobile devices, the augmented reality AR industry has undergone a series of increasingly important incremental evolutions. While slowly adopted during the early to mid-2010s, extraordinary progress was made throughout the pandemic years as visiting physical locations, and interacting with various physical items became non-viable for extended periods of time across the globe. In addition to its pandemic successes, many have heralded AR shopping as the green method to combat mass amounts of returned items from e-commerce stores clogging up landfills worldwide. These factors forced many to realize the wide-reaching strengths that augmented reality bears across a vast majority of industries. NexTech (OTCQX:NEXCF) currently has a market cap of $61.33M USD and alongside their spun-off subsidiary, ARway, boasts that they are the first publicly-traded AR solutions provider.

High-Quality Management Team

NexTech is helmed by CEO Evan Gappelberg, who's extensive history within the technology and M&A spaces drew him towards founding NexTech. Prior to starting NexTech in 2018, Evan was the founder and managing director of Atlas Advisors, an independent investment bank based in NYC. He then started NexTech with what he describes as "a back of the napkin idea" and a funding round of $3M. NexTech, and its vast portfolio of subsidiary companies are setting out to create a shared AR technology ecosystem that can provide users a full suite of solutions to bring their AR dreams to life! While this may seem like a daunting task, the journey will be championed and guided by the extensive experience that CTO Nima Sarshar brings to the table. To start, Nima is a born innovator who holds patents across a variety of machine learning, SEO, and multimedia learning platform applications. Nima's background is highlighted by his time as the principal data scientist at Intuit, his work with Apple's machine learning team, along with his experience as the co-founder of Threedy.ai, which was acquired and absorbed by NexTech in June of 2021. Nima has a history of spearheading revolutionary technological movements while turning grand designs into reality.

Financial Analysis

When looking at NexTech's financials, you'll see that not only does the company have fantastic revenue growth, but their balance sheet represents financial robustness. Let's begin with looking at NexTech's income statement.

As you can see, NexTech's revenue and gross profit are growing at high double digits, albeit we will know the company's real annualized growth over the past 3 years when they release their Q4 results. With that being said, even by judging their trailing 12-month results, we see that their revenue growth over the past 2 or so years has been impressive. When diving deeper, looking at NexTech's segment growth we see that their more recent technology services segment has been growing at 78%.

Although the company's top line has been growing at a solid pace, it is important to note that the company has yet to record a profit, which could raise uncertainty around the validity of the business model. Moving onto the balance sheet, we see that the company's cash position and short-term assets have grown enormously over the last couple of years.

Between NexTech's current ratio sitting at approximately 2.65, and their short-term assets outgrowing their short-term liabilities, NexTech's liquidity position appears healthy. Moreover, the company's capital structure has not changed at all over the past few years, being mainly composed of equity.

This is an indication that solvency risk is not too great for the firm currently, as most of NexTech's long-term liabilities consist of a capital lease and equity makes an overwhelming majority of the company's financing. Finally, we have the cash flow statement. Currently, NexTech is cashflow negative. Since the company is young and in their growth phase it makes sense that they would be a cash consumer and not a cash generator.

End of The Beginning For NexTech's Growth Story

NexTech's business has developed a launch pad and its business is ready for lift off. To begin. with, it's pertinent that we discuss Toggle 3D - NexTech's no-code 3D design studio that aims to capitalize on the forecasted $11B CAD design file market in 2023. This revolutionary program has been in use for multiple quarters, and luckily for investors NexTech's structure and mission permit, those who hold NexTech's stock will receive a stock dividend of Toggle3D within the next few months. This arrangement is nearly identical to the spinoff of ARway, which occurred on October 26 of last year and created immense shareholder value. For some context, ARway operates as a no-code mapping and spatial navigation platform that can be fitted to any size of space. Through the stock dividend of ARway issued to holders of NexTech, investors were able to enjoy what was initially a 4% yield on their NexTech shares. Additionally, the long term prospects of the AR market look very good. The AR market is estimated to grow at an astounding 41% annual rate until 2030. The main drivers for the augmented reality's industry growth in the coming years are the value adds to key industries like construction, agriculture, software development, education, and healthcare. Construction workers can generate 3D models for more effective blueprinting and connecting imagination with reality. Students can learn differently through 3D books and interactive gaming. Finally, Healthcare patients will be able to receive higher quality care through AR-powered healthcare.

There is no doubt that NexTech is currently operating in a market with impeccable growth prospects. Combined with the company's adequate management team and strategic synergies could mean that investors could obtain very high yields on its shares.

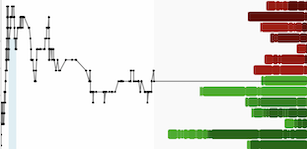

Valuation: Implicitly Overvalued

Despite NexTech's shares on the OTC exchange being down around 50% on the year, the company is trading at a premium when looking at the multiples of comparable companies. When looking at total enterprise value-to-revenue and price-to-tangible book value, NexTech's shares are overpriced.

Although on the ratio side, it may appear that NexTech's shares are overpriced, investors that really believe in NexTech's offerings may overlook the company's premium valuation because they believe in the business. In my opinion, I think NexTech's unique offerings are worth the premium share price.

Conclusion

To conclude, when you consider the company's unique AR ecosystem, their astounding top-line growth, as well as the future of the augmented reality industry, I think that NexTech could be poised for some heavy gains. However, this investment is very risky and only investors with the willingness and ability to potentially endure some heavy losses should be invested. Therefore, I am of the opinion that NexTech could possibly provide shareholders with alpha returns.