Hey folks, here's a quick lowdown on what's happening with the Canadian equity capital markets, particularly focusing on mining and metals companies. Looks like these guys are lighting the path while other sectors seem to be stumbling in the dark.

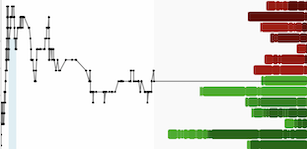

This year, materials sector firms have gathered up C$1.6 billion ($1.2 billion) on the Toronto Stock Exchange, and that's a solid 71% of the total raised by all companies on the exchange. Our star player? Capstone Copper Corp with a whopping C$327-million deal that kicked off in March.

This same trend's been reflected on the smaller TSX-Venture Exchange, where these hard-hat companies make up 75% of the total C$1.6 billion that's been raised this year.

Meanwhile, other sectors are in a bit of a rough patch trying to raise funds. In fact, the total equity issuance on the Toronto Stock Exchange is down by 7.5% from last year, and a lot of that's due to a 20% drop in capital raised by companies in the industrial, technology, energy, and consumer sectors.

But it's not all sunshine and rainbows for the mining firms. Some people are saying that the momentum for base metals is starting to slack off because of some disappointing economic data from China, which happens to be the big daddy consumer of industrial metals like copper and steel.

However, not all hope is lost. Even with the slowing down of base metal deals, there's an optimistic expectation that gold and silver miners are gonna take advantage of the equity markets, especially given the recent spike in gold prices which hit a multi-year high at over $2,050 an ounce.

Looks like gold's got the Midas touch right now, and that's causing a stir for more financings. So, keep an eye out, there might be some interesting developments on the horizon in the mining and metals sector!

#Gold #Metals

[Original article by Geoffrey Morgan, published on (https://www.mining.com/web/mining-firms-cash-raising-lifts-toronto-exchange-as-deals-slow/)]