Alright, buckle up, folks, because we're about to delve into the twisted world of short-selling. This financial tactic is often seen as bizarre—like trying to solve a Rubik's Cube while blindfolded. Even big shot sources like the Wall Street Journal often need to break down this concept for their readers. You essentially borrow and sell stocks that you suspect are overpriced, aiming to buy them back when prices drop, pocketing the difference. This strategy, as old as the market itself, often paints short-sellers as villains since they profit from bad news.

The original short-seller was Isaac le Maire, a founder of the Dutch East India Company. When his stocks took a nosedive, short-sellers were the scapegoats.

This theme echoes throughout history. Dick Fuld, ex-CEO of Lehman Brothers, blamed short-selling, among other factors, for the company's collapse.

Recently, Hindenburg Research made headlines by short-selling against Adani Group, accusing them of accounting fraud, sparking a bitter exchange.

Short-selling isn't a walk in the park. S3 Partners reveals short selling made around $300 billion last year as markets plunged, but it also offset about $572 billion in losses over the preceding three years.

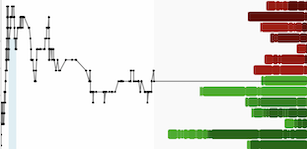

You've got to admire the audacity of short-sellers. This game isn't for the faint-hearted. Think about it. You're bucking the trend. Stocks usually climb over time, so scoring consecutive years of big losses on a stock is tough. Whitney Tilson, a hedge fund manager, had a roller coaster ride with short-selling, scoring big in 2008 and 2015 but mostly taking losses otherwise. Short-selling presents unique challenges due to its inverted risk/return profile. It's like playing poker with a deck that's stacked against you.

In Barton Biggs's book, "Hedgehogging," he shares Jock Robinson's disastrous short-selling experience, which resulted in massive losses and his fund shrinking from $400 million to a measly $80 million.

Modern short-sellers face new hurdles, such as the requirement to disclose their positions publicly in certain jurisdictions.

Like Robinson, today's short-sellers have to dance with the devil in the moonlight. You might find yourself right in the thick of it, just like the Volkswagen short-sellers in 2008 and GameStop in 2021. Either way, the world of short-selling is no kiddie pool; it's a shark tank. Remember, in this game, you're not just playing against the house, you're playing against the entire market.

[Original article by Marc Rubinstein, published on https://www.netinterest.co/p/the-art-of-short-selling-770]

#Investing #StockMarket