Look, the copper market's taking a hit, guys, and the little guys are getting socked the hardest. Miners are chopping production, begging for fresh investors to help them tough out this rough patch. This is according to a bunch of execs who chatted with Reuters.

Let's not forget that copper's a big player in the move towards cleaner tech, so the big miners with money are grabbing assets with potential for long-term mining and high-grade ore.

But with a slump in prices thanks to global economic worries, the small-to-mid-sized outfits are scrambling to cut costs anywhere they can. However, they might not weather the storm, and we could see more buyouts in the sector.

The numbers show the truth. Copper M&A's been getting busy, with about $22 billion in deals launched this year. That includes Hudbay Minerals' $439 million bid for Copper Mountain, and Newmont Corp's hefty $18 billion plan to snap up gold and copper miner Newcrest.

It's a tough game developing new copper mines, so the big guys are just buying out companies instead, says Stuart McDonald, CEO of Taseko Mines.

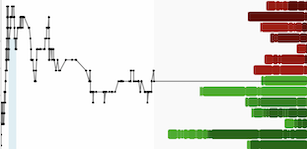

Copper prices have been sliding since peaking seven months ago, and the Chinese think it's gonna drop to $7,000 per ton or $3.18 per pound later this year due to less demand.

The bottom line is, when copper drops below $3.50, some companies are just gonna fold, says Peter Kukielski, Hudbay Minerals CEO. This presents an opportunity for some M&A action.

It's like a crazy mining soap opera, folks, where the big companies are waiting to pick up the scraps. And you gotta wonder, are these junior miners gonna find a white knight to save them, or are they just gonna be next on the buyout list?

[Original article by Divya Rajagopal and Melanie Burton, published on https://www.mining.com/web/smaller-miners-hunger-for-cash-grows-as-copper-prices-fall-sparking-ma-bets/]

#Copper #Investing